Are you feeling overwhelmed by piles of debt? It's time to regain control and strive for a brighter financial future. Our qualified team of consultants can help you navigate the challenges of debt management. We'll develop a personalized plan that addresses your unique situation. Don't let debt control your life any longer.

- Start your journey to financial freedom today!{

- Reach out us for a no-cost consultation.

Consolidate Your Debts and Streamline Payments

Are you struggling to keep up with multiple debt payments? A debt consolidation loan could be the answer you need. By combining your various debts into a single monthly payment, you can gain control of your money. This simplifies your financial picture and may lower your overall interest rate.

- Evaluate the terms and conditions of any consolidation loan before you commit.

- Compare offers from different lenders to find the best deal for your needs.

- Be aware that a debt consolidation loan is not a quick fix. It's essential to create a budget to avoid falling back into debt.

Negotiate Lower Debts Through Strategic Settlement

Drowning in loans|? Don't give in to the stress of overwhelming payments. A clever settlement can considerably reduce your financial burden and put you on a firm path to consolidation.

- Communicate with your lenders openly and honestly about your budgetary situation.

- Investigate various settlement options, including payment consolidation or a structured payment plan.

- Consult the assistance of a credit advisor to navigate complex legal matters.

Remember that tactical settlement requires patience and a clear plan.

Dispute Unfair Charges and Regain Your Finances

Have you recently noticed unfamiliar charges on your statement? Don't let it slide. Taking swift action is crucial when dealing with possible financial mistakes. First, carefully review your transactions to pinpoint the exact charges in question. Then, promptly contact your financial institution and detail the situation. Be assertive in demanding a thorough investigation of the charges.

- Utilize your financial safeguards.

- Keep detailed records of all communication with the provider.

- Consider seeking help from a consumer protection agency.

Remember, you have the power to fight unfair charges and regain your hard-earned finances.

Debt Relief Solutions Designed to Your Needs

Feeling overwhelmed by mounting debt? You're Natural Estrogen Support not alone. Many individuals and families face similar challenges, but there are solutions available to help you regain control of your finances. A wide range of debt relief options exists, each with unique benefits and considerations. It's essential to carefully evaluate your situation and choose the strategy that best aligns with your goals and circumstances.

Our team of experienced financial advisors is dedicated to providing personalized guidance and support throughout your journey. We offer a comprehensive evaluation of your debt, taking into account factors such as your income, expenses, and credit history. Based on this information, we will develop a customized solution that addresses your specific needs.

Whether you're seeking to merge your debts, negotiate lower interest rates, or explore other options like debt management, we are here to help you navigate the complexities of debt relief.

Our commitment is to empower you with the knowledge and resources necessary to make informed decisions and achieve financial security. Contact us today for a free review and let us help you find the path toward a brighter financial future.

Regain Control : A Path to Financial Freedom

Financial freedom can seem like a distant dream, especially when you're struggling financial obstacles. But don't give up. It's never too late to make a change of your finances and chart a course towards a more secure future.

The first step is to analyze your current financial situation. Take a close scrutiny at your income, expenses, and debt. Recognizing where your money is going is crucial for formulating a plan to get back on track.

Once you have a clear picture of your finances, you can start to develop a budget that aligns with your goals. Distribute your income wisely, prioritizing essential expenses and dedicating room for savings .

Remember, financial freedom is a voyage that requires patience . There will be obstacles along the way, but by staying committed , you can realize your financial goals.

Consult professional counsel if needed. A financial advisor can offer personalized plans to help you maximize your financial well-being .

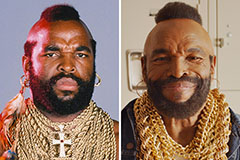

Mr. T Then & Now!

Mr. T Then & Now! Daniel Stern Then & Now!

Daniel Stern Then & Now! Alexa Vega Then & Now!

Alexa Vega Then & Now! Keshia Knight Pulliam Then & Now!

Keshia Knight Pulliam Then & Now! Peter Billingsley Then & Now!

Peter Billingsley Then & Now!